Services

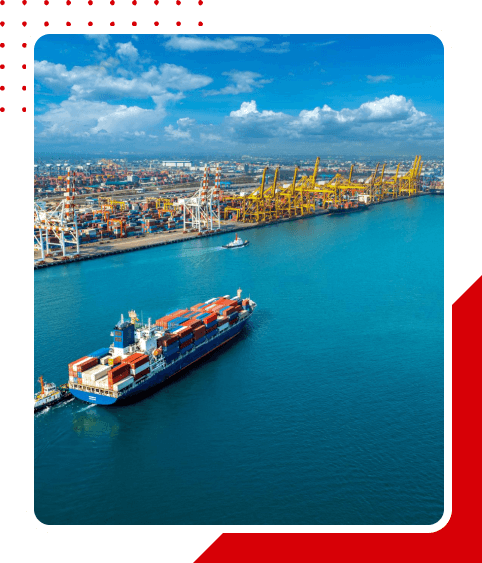

Import Financing

International Procurement

Collateral Management

Quick loan to Clearing Agent

Vehicle Evaluation and

Loans for Duty Payment

How We Deliver Your Parcel

Register

Payment Processing

In-Transit

Payment Recieved

Our Core Features

Transparent Price

Security For Cargo

Warehouse-Storage

Easy Payment method

Real-Time Tracking

24/7 Hour Support

What Mostly People Ask About Us

Our financing solutions are available to:

Freight forwarders

Transport and trucking companies

Warehouse operators

Importers and exporters

E-commerce logistics providers

Small and medium-sized logistics service providers

We offer a range of flexible options, including:

Invoice Financing / Factoring: Get immediate cash by using unpaid invoices as collateral.

Working Capital Loans: Cover short-term operational costs.

Equipment and Vehicle Financing: Purchase or lease trucks, containers, and machinery.

Trade Finance: Fund import/export shipments or supplier payments.

Fuel and Operating Expense Loans: Manage day-to-day logistics costs.

Requirements may vary by product, but typically you’ll need:

A registered business in the logistics or supply chain sector

Proof of business operations (e.g., contracts, invoices, delivery records)

Minimum trading history (usually 6–12 months)

Acceptable credit and financial stability